Meril -ADIA $200 m deal .A Boost for Indian Med Tech

Micro Life Sciences Pvt. Ltd., also called Meril Life Sciences, was established in Vapi, Gujarat, in 2006 by the Bilakhia Group and has since developed into one of the leading domestic medical device firms in India. Meril has become a major force in the global medical technology (MedTech) market by putting a strong emphasis on innovation, research, and international quality standards.economictimes.com

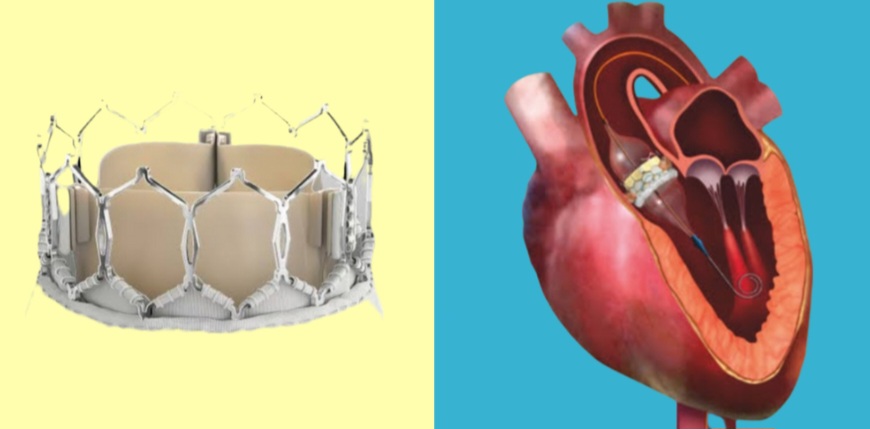

Cardiovascular, orthopedic, endosurgery, ENT, and in-vitro diagnostics are the five main therapeutic domains in which Meril works. The MyVal transcatheter aortic valve system (TAVR), MeRes100 bioresorbable scaffold, MISSO robotic-assisted joint replacement system, and, most recently, MyClip, a minimally invasive device for mitral valve repair using the TEER technique, are just a few of the company’s ground-breaking products. These goods show Meril’s dedication to creating cutting-edge medical solutions in India for international markets, in addition to manufacturing them.

Meril is expected to generate between ₹3,000 and 3,500 crore (~USD 360 and 420 million) in revenue as of FY 2023–2024. The company has operations in more than 100 countries and employs more than 10,000 people. One of the most cutting-edge vertically integrated manufacturing and research and development facilities in Asia is located in Vapi, and it reflects Meril’s sustained commitment to quality, innovation, and regulatory excellence.

The Abu Dhabi Investment Authority (ADIA) made news in July 2025 when it announced that it will invest USD 200 million in Meril, obtaining a roughly 3% equity share. Meril is valued at around USD 6.6 billion (₹56,000 crore) as a result of this investment, which is a remarkable accomplishment for an Indian MedTech business.

Strategic investment by ADIA

Both parties claim that Meril’s robust growth trajectory, clinical innovation, and growing global footprint were the main factors in the decision. With the help of ADIA’s investment, Meril should be able to expand internationally more quickly, improve clinical research capacity, draw in talent from around the world, and expedite regulatory clearances in key regions. In addition to confirming Meril’s reputation around the world, this collaboration shows that foreign trust in India’s MedTech sector is growing.

More than just a business deal, the Meril-ADIA agreement signifies a strategic partnership between international investment and India’s burgeoning healthcare innovation industry. With an eye on the future, Meril wants to expand its capacity for research-driven manufacturing and provide the world with reasonably priced, superior healthcare technologies.

Meril Life Sciences is a potent illustration of how local innovation supported by international investment may transform the future of medicine both domestically and internationally as India’s healthcare system quickly changes.

Notable:

The ADIA-Meril deal is a landmark moment for Indian MedTech. With a $200 million investment valuing Meril at $6.6 billion, it highlights global trust in India’s healthcare innovation. Beyond capital, ADIA’s support reinforces Meril’s global ambitions, boosting R&D, clinical trials, and market reach. This partnership showcases how Indian innovation can attract world-class investment and lead the future of global medical technology.

For more such insights stay connected with us onmoneypistol.com